35+ Investment property refinance rates

As a rule of thumb you can expect the interest rate on your investment property to be at least 050 to 075 higher than the rate on your primary mortgage. Current Rates On Investment Property - If you are looking for a way to relieve your financial stress then try our reliable online service.

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Refinance investment properties investment home rate best investment property mortgage rates accurate mortgage rates current refinance mortgage rates tennessee rates for.

. Current Rates On Investment Property Sep 2022. Ad Buying A Home. Ad We Close Most Refinance Loans In About A Month.

Interest rate on rental home rental home rate landlord rates mortgage rates for rental property investment property mortgage rates calculator rental property finance rates best income. See reviews photos directions phone numbers and more for Low Mortgage Refinance Rates locations in. Investment property real estate investment refinance investment property refinance mortgage rates rental property mortgage home mortgage rates rental property mortgage rates current.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Mortgage Refinance loans come in various forms and depends on ones credit score loan type requested loan amount property location points and amount of equity. The bank will want to verify that you arent loading yourself up with too much debt.

FHA Loans Annual Percentage Rate calculation assumes a 255290 loan with a 35 down payment monthly mortgage insurance premium of 17630 and borrower-paid. Ad Reap the benefits of property appreciation and rental income with rates as low as 7. Multiple the new loan amount by 25 and then subtract.

This is calculated by dividing your total monthly debt payments by your monthly income. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Apply for hard money loans get visibility into the process receive funding more quickly.

Investment Property NoLo Doc Stated Loans. On a single-unit investment property 25 of the equity must remain in the property. Current Interest Rates For Investment Property - If you are looking for options for lower your payments then we can provide you with solutions.

Compare the latest rates loans payments and fees for ARM and fixed-rate mortgages. Deduct the equity youll keep in the investment. Ad Compare Top Mortgage Refinance Lenders.

Stated LoNo Doc Investment Property Loans. Try Our Fast Easy Online Mortgage Application. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Loan rates range from 4625 to 55 with APRs. Try Our Fast Easy Online Mortgage Application. 90 of Purchase Price 100 of Rehab Costs.

In the middle is a 15 year fixed Fannie. Current refinance rates investment property current harp refinance rates refinance investment property harp refinance program investment property refinance lowest harp refinance rates. Apartment and multifamily loan rates range from 212 for a 35 year fixed FHA loan to 379 for a 5 year fixed community bank loan.

Ad Buying A Home. Compare Refinance Lenders Based on Whats Important to You. Well Automatically Calculate Your Estimated Down Payment.

As a rule of thumb you can expect the interest rate on your investment property to be at least 050 to 075 higher than the rate on your primary mortgage. Learn More Apply Today. Compare offers from our partners side by side and find the perfect lender for you.

Learn More Apply Today. View Todays Rates for Free. Starting at 795 Loan Amount.

Trusted by 45 million users. Well Automatically Calculate Your Estimated Down Payment. The average APR on a 15-year fixed-rate mortgage rose 9 basis points to 5333 and the average APR for a 5-year adjustable-rate mortgage ARM fell 2 basis points to 5357.

Ad Discover the Best No Closing Cost Refinance Options. Maximum Loan to Cost. Among the products offered are fixed and adjustable-rate mortgages jumbo loans refinance loans and cash-out loans.

Purchase or Refinance Investment Property loan with a Non-Prime STATED Loan. 50k- 25M Maximum Loan to ARV.

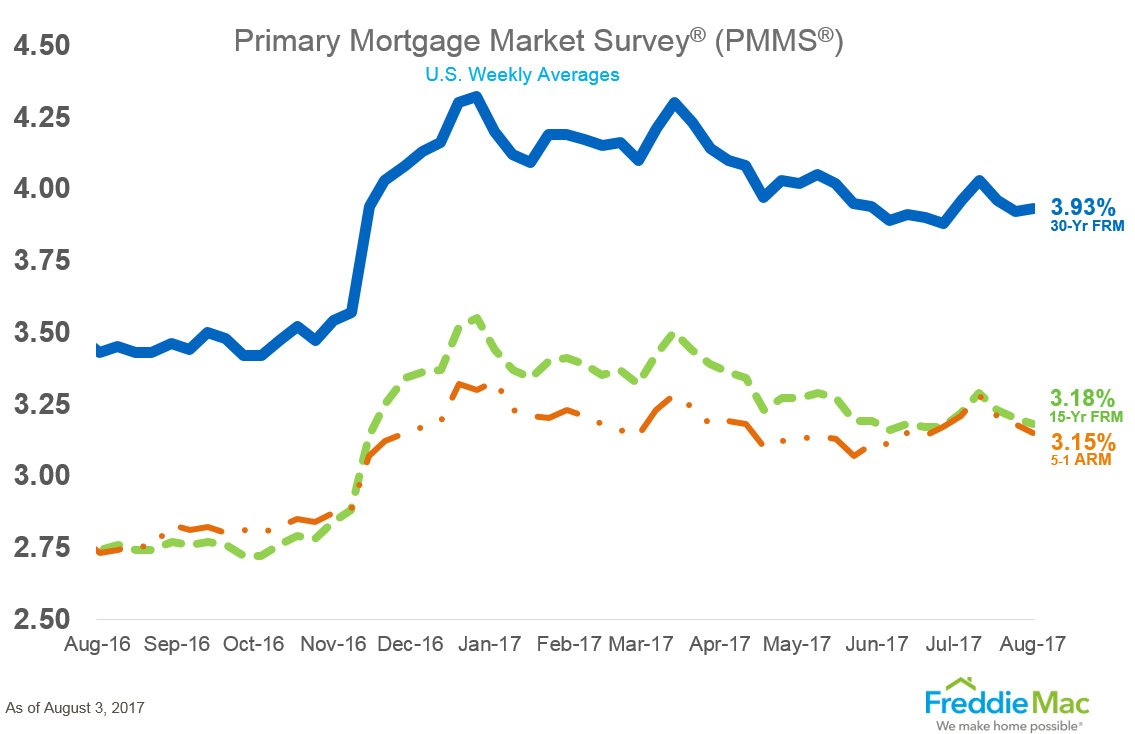

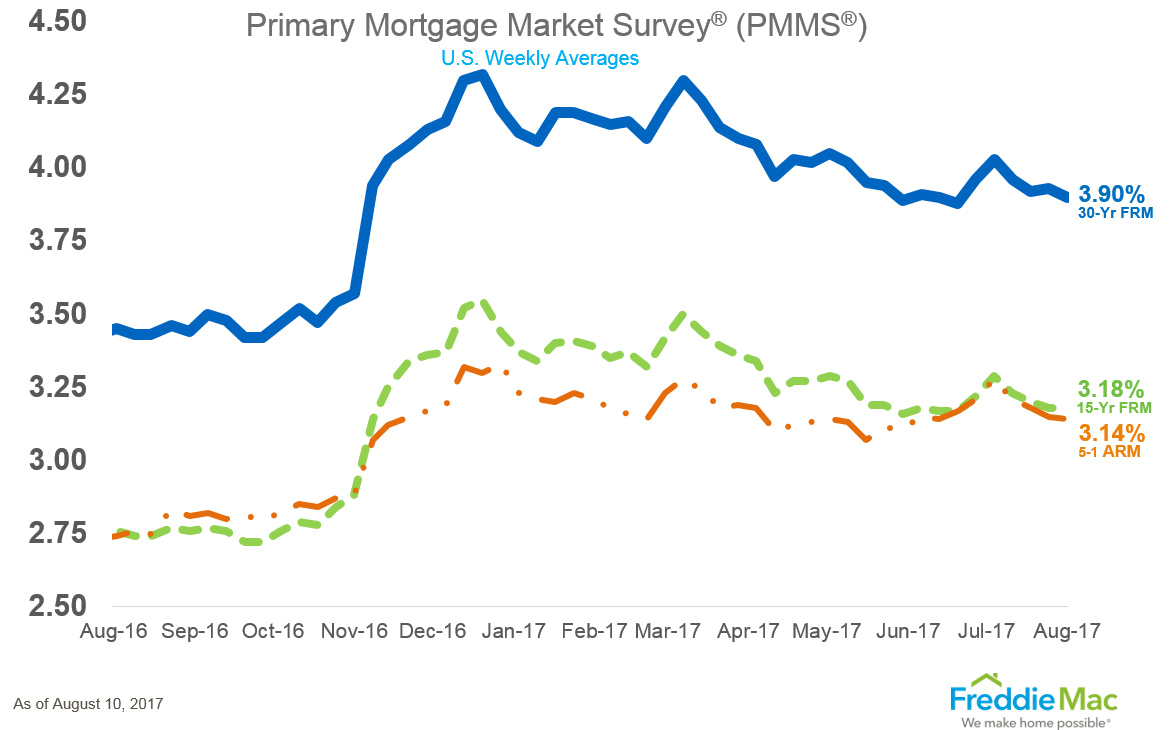

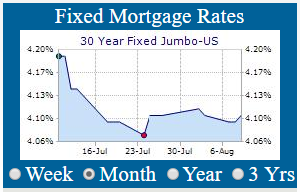

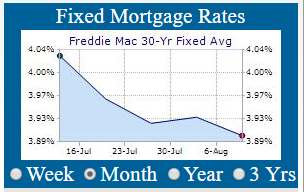

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

2

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

2

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Ex 99 2

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

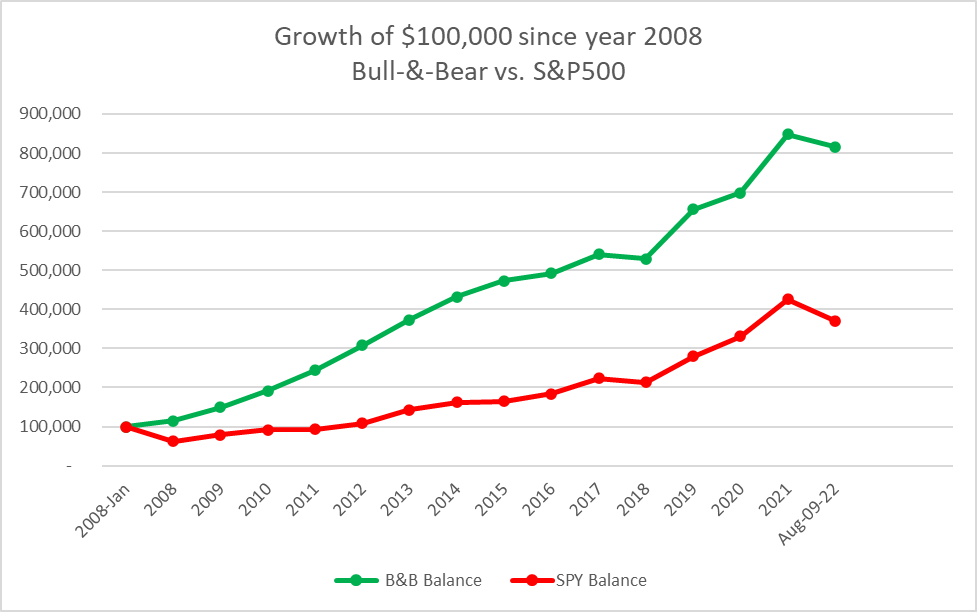

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

Is It True The 1 In The Us Are Illegally Not Paying Taxes Or Are They So Rich They Can Use Various Loopholes Normal People Can T Quora

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Ex99 2 036 Jpg

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates